As an owner of a business, you invest tremendous personal time and effort to develop your business. Your primary focus mainly lies on marketing, making sales and maintaining a better customer relationship. On the other hand, you want to save any cost that can be managed by yourself but often end up doing things in a wrong way, such as accounting.

A good business practice starts with regular review of financial information. How regular? Some must be done daily while others can be reviewed monthly, quarterly, or annually. Take closing the books as an example; we suggest doing it monthly.

The purpose of the monthly close is to provide accurate financial reports and key performance indicators to assist management in overseeing the organization. The close helps drive performance, increases accountability, and strengthens internal controls. The close involves examining both Balance Sheet and Profit and Loss accounts to ensure that these are correct. Accuracy is ensured through reconciliations, analysis, and comparisons.

The benefits of closing your books monthly are:

- This biggest benefit of month-end closing is accuracy. It’s much easier to get a handle on your books month-by-month than it would be at the year’s end because your data is divided into smaller pieces. A duplicate record or a missing transaction doesn’t pose nearly the same threat when it is caught early.

- Another benefit of month-end closing is reporting and decision making. It gives business owners access to reporting that can help them make more informed decisions down the road. When business owners can see trends and patterns month-over-month, they can more accurately predict changes in revenue or even wider changes in the marketplace.

- Finally, month-end closing helps simplify audits and tax filing. Your data is accessible, organized, complete, and accurate.

What do you need?

Month-end closing procedures vary depending on your business and industry, but you’ll most likely need access to your:

- Revenue

- Open Sales Orders

- Purchase Orders

- Fixed Assets

- Accounts Payable/Receivable

- Credit Card Statements

- Bank Statements

- Cash Statements

- Sales Tax Statements

There’s different ways to do the monthly close, however the end product of the monthly close is a report to management which includes financial statements, key performance indicators and a narrative explaining significant variances from budget or prior period. The management report is a value add that accountants provide to the organization, assisting other members of the organization to make informed business decisions.

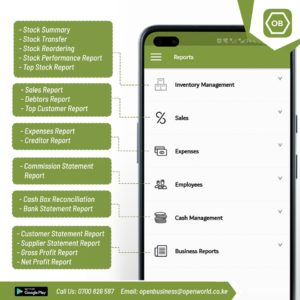

OpenBusiness Can Make Monthly Close, Bookkeeping and reporting really simple:

With a whole suite for Accounts and Bookkeeping, you can:

- Create invoices, LPOs, Receipts,

- Get Access to Supplier and customers statements easily.

- Get a full accounting solution for today’s SMEs.

- Get real time reports on inventory, sales, expenses, cash management and business reports.

Try OpenBusiness today and join over 1000 SMEs using our app to make better and faster business decisions with less headaches!

Available From only Kshs 500 per month.

Download the app for free via: https://bit.ly/OBPOSapp

Leave a Reply